-

Car Reviews

- All reviews

- Midsize SUVs

- Small cars

- Utes

- Small SUVs

- Large SUVs

- Large cars

- Sports SUVs

- Sports cars

- Vans

Latest reviews

- Car News

-

Car Comparisons

Latest comparisons

- Chasing Deals

Australia’s automotive market comprises over 20 Chinese car brands… What do we know about them?

Nearly 60 global car brands are currently battling in Australia’s local new-car market, and by the end of 2025 about a quarter of those will hail from China.

Chinese cars have come a long way since 2009, when Great Wall became the first brand from the world’s biggest automotive market to launch in Australia (and alone until Chery joined it in 2011).

The exponential growth has only happened in more recent years, however. Between 2019 and 2024, China’s percentage of total vehicle imports to this country jumped from less than two percent to 14%.

Based on official industry figures, Chinese cars are trending to account for a fifth of the Aussie new-car market by the end of this year.

The Chinese car industry is booming, last year selling about 31 million cars locally and exporting millions more across the globe.

Despite the relatively small size of the local market — sales topped out at 1.2 million last year — Chinese brands continue to launch relentlessly in Australia.

Aggressively cheap pricing aside, China’s car makers are also capitalising on the growth in hybrid, plug-in hybrid and battery electric vehicle sales.

This is the industry that China dominates, with an onslaught of cheap battery-vehicles that rivals struggle to match on price.

This is Chasing Cars’ comprehensive guide to understanding who’s who from China — with the lowdown on company backgrounds, best-selling models, global sales, and future plans. All information presented is correct up to mid-October, 2025 unless stated otherwise.

Founded: 2003

Parent company: BYD Company

Local importer: BYD Australia as of July 2025 (Previously EVDirect)

First appeared in Australia: 2022

Aussie sales ranking: 8th

Current model lineup: Dolphin compact electric hatch, Atto 1 small electric hatch, Atto 2 compact electric SUV, Atto 3 small electric SUV, Seal medium electric sedan, Sealion 5 midsize plug-in hybrid SUV, Sealion 6 midsize plug-in hybrid SUV, Sealion 7 midsize electric SUV, Sealion 8 large plug-in hybrid SUV, Shark 6 plug-in hybrid dual-cab ute

Lowest starting price in Australia: $29,990 Before on-road costs (Dolphin Essential)

Most popular model in Australia: Shark 6

BYD has quickly established itself as a volume-selling EV and PHEV brand in Australia. Originally released to the Australian market with the Atto 3, BYD took just three years to become highly acclaimed.

Popular vehicles from BYD include the Shark 6 PHEV, which pioneered the plug-in ute segment in Australia, BYD Sealion 6, which rapidly became one of Australia’s favourite plug-ins, and the BYD Sealion 7, which has similar success in the midsize EV segment.

BYD has furthered its dedicated to electrification with the confirmation of the Atto 1 and 2, as well as the Sealion 5 and 8. These four vehicles have great potential to shake up the both the EV and PHEV market in a substantial way, promising great EV/PHEV range figures, high levels of equipment, and enticing prices.

Read more: BYD Shark 6 2025 review

Founded: 1997

Parent company: Chery Holding Group Co

Local importer: Chery Australia as of March 2023 (previously Ateco from 2011-2015)

First appeared in Australia: 2011

Aussie sales ranking: 13th

Current model lineup: C5/E5 small electric SUV, Omoda 5 midsize SUV, Tiggo 4 Pro small SUV, Tiggo 7 Pro midsize SUV, Tiggo 8 Pro LWB midsize SUV, Tiggo 9 large plug-in hybrid SUV

Lowest starting price in Australia: $23,990 drive-away (Tiggo 4 Urban)

Most popular model in Australia: Tiggo 4

Working hard to become a household name in Australia, Chery Motors has spearheaded an aggressive pricing strategy now shared with several Chinese brands. Chery is best known for its vast array of midsize SUVs, many of which offer plugless and plug-in power.

Chery has seen continued success with the sharp pricing of its Tiggo 4, Australia’s cheapest small SUV, which now sits comfortably at the top end of the Oz small SUVs segment.

Read more: Chery Tiggo 4 vs MG ZS 2025 Comparison review

Founded: 2008

Parent company: China Changan Automobile Group Co.

Local importer: Inchcape

First appeared in Australia: 2024

Aussie sales ranking: 48th

Current model lineup: S07 midsize electric SUV, S05 small electric SUV, E07 electric crossover dual-cab ute

Lowest starting price in Australia: $53,900 before on-road costs (S07 RWD midsize SUV)

Most popular model in Australia: S07

Deepal is a new player in the Australian market, recently launching with a sole model, the S07 midsize electric SUV. Upon launch, the S07 was heavily criticised for its intrusive and obnoxious AI voice feature, which would loudly broadcast unhelpful messages to the driver.

That problem, fortunately, is now rectified.

Deepal will soon launch its S05 small SUV and E07 crossover ute – both are dedicated EVs. The E07 is hotly anticipated due to its unique body shape and genuine use case for the Australian market.

Read more: 2026 Deepal S07 crossover ute Australian first drive

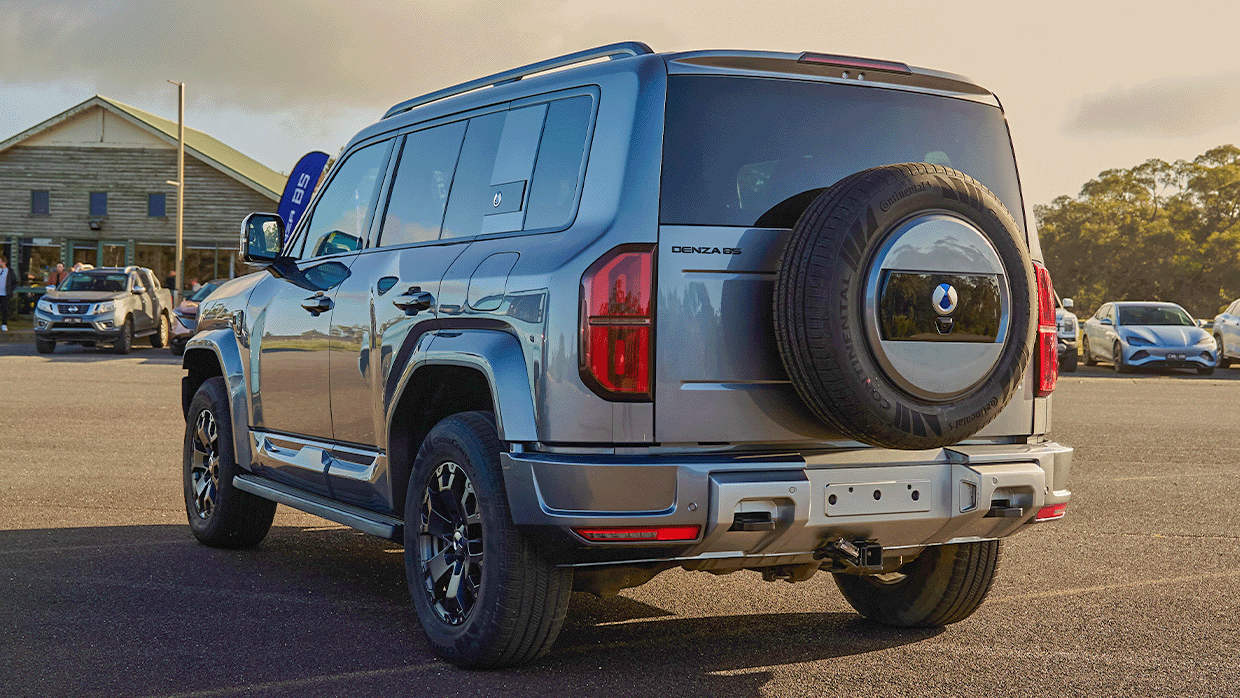

Founded: 2010

Parent company: BYD Company

Local importer: BYD / Denza Australia

First appeared in Australia: 2025

Aussie sales ranking: TBC

Current model lineup: B5 midsize off-roader and B8 large off-roader. U8 large off-roader likely to follow.

Lowest starting price in Australia: TBC

Most popular model in Australia: TBC

Denza will soon launch into the Australian market as the luxury arm of BYD. A well-known brand in China, Denza is likely to offer premium products at incredibly sharp prices, undercutting luxury rivals from Japan, Germany and Korea.

Expect Denza to take on other recently established luxury Chinese brands, predominantly Zeekr (owned by Geely), and IM Motors (operated by MG).

Read more: BYD Denza B5 2025 review: International first drive

Founded: 1969

Parent company: State-owned Assets Supervision and Administration Commission of the State Council (SASAC)

Local importer: Two under consideration: iGlobal Zero Emission Vehicles (IGZEV) and Auga (AGA) Auto

First appeared in Australia: 2025

Aussie sales ranking: N/A

Current model lineup: Unconfirmed. Forthing Friday midsize electric SUV, Nammi Box and/or Nammi 06 small electric SUVs, and M-Hero 1 large off-roader likely

Lowest starting price in Australia: TBC

Most popular model in Australia: TBC

Despite being far from a household name locally, Dongfeng is China’s fourth-largest automaker. Now in the final stages of planning before its local inception, the Chinese state-owned company has serious potential to make a lasting impression on Aussie punters.

Founded: 2016

Parent company: Zhejiang Geely Holding Group (ZGH)

Local importer: Jameel Motors

First appeared in Australia: 2025

Aussie sales ranking: N/A

Current model lineup: SuperVan electric commercial van, H9E electric heavy rigid truck

Lowest starting price in Australia: $71,490 before on-road costs (SWB low-roof SuperVan)

Most popular model in Australia: N/A

Farizon is a new player in the Australian market, entering with a focus on electric commercial vehicles. This is largely to avoid infighting with parent brand Geely, and sister brand Zeekr.

For this reason the Farizon SuperVan is offered in commercial trim only, despite offering a people mover configuration overseas, to prevent steering buyers away from the Zeekr 009.

Read more: Geely Farizon displays all-electric ‘SuperVan’ for the first time

Founded: 1996

Parent company: Beijing Automotive Group Co. (BAIC)

Local importer: Inchcape (passenger and light commercial), Foton Mobility Distribution (heavy commercial including trucks and buses). Previously FAA Automotive Australia followed by Ateco.

First appeared in Australia: 2012

Aussie sales ranking: N/A

Current model lineup: Tunland V7 / V9 dual-cab utes, Aumark S Tipper and Cab Chassis light-duty trucks.

Lowest starting price in Australia: $39,990 Before on-road costs (Tunland V7-C 4×2 dual-cab)

Most popular model in Australia: N/A

The name might not be familiar to the average Australian, but there’s a high chance you’ve seen plenty of their light trucks sporting a fetching Woolworths livery. Back home in China, Foton takes the trophy of being the country’s largest commercial vehicle manufacturer.

Foton’s first foray into Oz was in 2012. It endured a rocky start, changing importers three times before departing in 2019. Now, Foton has returned with factory backing. To succeed, Foton needs to compete in a market even more fierce than the one it stepped out of six years prior.

Founded: 1948

Parent company: Guangzhou Automobile Industry Group Co Ltd (GAIG)

Local importer: GAC Australia

First appeared in Australia: 2024

Aussie sales ranking: N/A

Current model lineup: Unconfirmed. AION V small electric SUV, Emzoom small SUV, and E9 plug-in hybrid people-mover likely to headline brand launch later this year.

Lowest starting price in Australia: TBC

Most popular model in Australia: TBC

GAC joins an ever-growing list of successful automakers from China looking to secure a footing in Australia, with the company describing Australia as a “lucrative opportunity”.

Like many other market entries, GAC will enter the Oz market with a small electric SUV and combustion SUV. The ace-in-the-sleeve for GAC will be its E9 plug-in MPV — a would-be first for the Australian market.

Sharp pricing and good on-road manners will be essential for the E9 if it is to defeat the segment leading Kia Carnival. In 2024, just 1.2 percent of all vehicles sold were MPVs; 74 percent of those sales went to Kia.

Read more: The latest automaker from China itching for a spot amongst Australia’s top sellers

Founded: 2003

Parent company: Zhejiang Geely Holding Group (ZGH)

Local importer: Geely Australia (previously John Hughes Geely in WA)

First appeared in Australia: 2010 (WA only: Geely MK small hatchback)

Aussie sales ranking: 31st

Current model lineup: EX5 midsize electric SUV, Starray EM-i midsize plug-in SUV

Lowest starting price in Australia: $39,990 before on-road costs (Starray EM-i Complete)

Most popular model in Australia: EX5

For a long time in Australia, Geely was known as the ‘brand behind the curtain’ mastermind of its subsidiaries Lotus, Zeekr, and Volvo in the Australian market without having a direct footing.

As of March 2025 however, that reputation was set to change, with Geely formally launching as a brand along with its front-driven EX5 midsize EV. Seven months later, the brand expanded again, this time launching the closely related front-driven Starray plug-in hybrid.

Geely hopes its two midsize SUVs will out-price respective segment rivals, like the BYD Sealion 6, MG S5, and GWM Haval H6, to become established in two of the nation’s fiercest segments.

Read more: Geely Starray hybrid pricing undercuts BYD’s Sealion 6 but trails Chery Tiggo 7

Founded: 1984

Parent company: Baoding Great Wall Holdings Company

Local importer: GWM Australia (previously Ateco from 2009-2016)

First appeared in Australia: 2009 (launched with V240 and SA220 dual-cab utes)

Aussie sales ranking: 7th

Current model lineup: Cannon dual-cab ute, Cannon Alpha dual-cab plug-in hybrid ute, Haval H6 midsize SUV, Haval H6 GT midsize SUV, Haval H7 midsize plug-in hybrid SUV, Haval Jolion small SUV, Ora small electric hatchback, Tank 300 midsize off-roader, Tank 500 large off-roader

Lowest starting price in Australia: $24,990 drive-away (Haval Jolion Premium)

Most popular model in Australia: Haval Jolion

Great Wall is Australia’s longest serving and most successful Chinese brand. Initially entering the local market 15 years ago, GWM now ranks seventh overall for vehicle sales volume, above BYD and Isuzu, but below Kia and Mitsubishi.

GWM first began selling locally with its V240 and SA220 low-cost dual cabs, which started at less than $20,000 (~$30,000 in 2025).

The brand still offers several products In the dual cab segment, setting the precedent of correlating Chinese-made cars with inexpensive entry prices — a philosophy is now shared by JAC, LDV, BYD, Foton, and soon MG.

GWM’s model range spans far beyond utes however, offering several vehicles within hotly contested SUV and off-road segments in Australia.

Founded: 2023

Parent company: Chery Holding Group Co

Local importer: Chery Australia

First appeared in Australia: 2025

Aussie sales ranking: N/A

Current model lineup: Unconfirmed. V23 small electric off-roader and V27 large plug-in hybrid off-roader expected

Lowest starting price in Australia: N/A

Most popular model in Australia: N/A

Expected to launch locally in 2026, ICaur is an electric off-road lifestyle SUV brand owned by Chery Motors. No model range is currently confirmed for Australia, however, we anticipate the brand to launch with its larger-than-Jimny sized V23 EV and G-Wagen sized V27 PHEV.

Read more: Chery iCar V23 is every cool 4×4 rolled into one BEV wagon

Founded: 2020

Parent companies: Shanghai Automotive Industry Corporation (SAIC) Motor (54%), Alibaba Group (18%) Zhangjiang Hi-Tech (18%)

Local importer: MG Australia

First appeared in Australia: 2025

Aussie sales ranking: N/A

Current model lineup: IM5 midsize electric sedan, IM6 midsize electric SUV

Lowest starting price in Australia: $60,990 drive-away (IM5 Premium)

Most popular model in Australia: IM6

IM Motors looks to rival big name European carmakers like BMW, Audi and Mercedes-Benz, acting as MG Motors’ premium sister brand. In essence, IM Motors is to MG what Lexus is to Toyota.

The brand launched early into 2025 with two electric vehicles: The Tesla Model 3 rivalling IM5 medium electric sedan, and Model Y rivalling IM6 midsize electric SUV. Both models offer a choice of 75kWh or 100kWh battery and 400V or 800V electronic architecture.

Founded: 2023

Parent company: Chery Holding Group Co

Local importer: Omoda Jaecoo Australia

First appeared in Australia: 2023 (Omoda 5 launched under Chery brand)

Aussie sales ranking: 36th

Current model lineup: Jaecoo J5 small SUV, Jaecoo J7 midsize SUV, Jaecoo J8 large SUV, Omoda 9 midsize plug-in SUV

Lowest starting price in Australia: $31,990 Before on-road costs (J7 Core FWD)

Most popular model in Australia: J7

Once two individual companies – Chery Omoda and Jaecoo – parent brand Chery Australia has combined its two luxury brands to form Omoda Jaecoo. The company offers a varied range of SUVs, with many being built upon the same platform as current Chery models.

Read more: Omoda 9 Virtue SHS 2025 review

Founded: 1964

Parent company: Anhui Jianghuai Automobile Group Corp

Local importer: LTS Auto

First appeared in Australia: 2012 (as a heavy commercial brand)

Aussie sales ranking: 40th

Current model lineup: T9 dual-cab ute, Hunter plug-in dual-cab ute, T9 EV (currently under evaluation within WA mining site testing), N55 and N75 electric heavy trucks

Lowest starting price in Australia: $42,662 before on-road costs (T9 Oasis 4×4 dual-cab)

Most popular model in Australia: JAC T9 4×4

A longstanding commercial brand in China, JAC has recently re-entered the Australian market with a trade focus. JAC first arrived in Oz with aspirations of becoming a staple heavy-commercial brand, but has since re-focused its attention to include an array of utes.

JAC first released its diesel-powered T9 light commercial dual cab in 2024, and will soon offer its hotly anticipated Hunter plug-in hybrid. An electric version of the T9 — known as the T9 EV — is also under consideration. JAC is currently testing its T9 EV in several WA mines.

Read more: Jac Hunter PHEV Ute 2026: 385kW/1000Nm ute makes its global debut in Melbourne

Founded: 1993

Parent company: Shanghai Automotive Industry Corporation (SAIC) Motor

Local importer: Ateco

First appeared in Australia: 2012 (Maxus / LDV Cargo van)

Aussie sales ranking: 20th

Current model lineup: D90 Large SUV, Deliver 7 / eDeliver 7 SWB van, Deliver 9 / eDeliver 9 LWB van and cab chassis, Deliver 9 light rigid bus, G10+ SWB van / MPV, Mifa / Mifa 9 MPVs, eT60 electric dual-cab ute, T60 Max dual-cab ute, Terron 9 dual-cab ute

Lowest starting price in Australia: $38,937 drive-away (G10+ van with six-speed manual)

Most popular model in Australia: T60 Max

LDV has long been associated with a light commercial buyership, headed by its large, often dent-rich unbranded Deliver 9 courier vans, sooty, unwashed G10 medium vans, and ‘cheaper by the dozen’ fleet focused T60 dual cab utes.

In recent years, however, LDV has stepped up its game to better target private buyers, expanding from up-market T60 trims to offer the passenger focused Terron 9 multi-link rear end dual cab, D90 seven-seater ‘family truckster’ SUV, and six or eight seat ‘airport hauler’ Mifa MPV.

Read more: LDV Terron 9 2025: New, bigger ute outprices Toyota Hilux and Ford Ranger

Founded: 2015

Parent companies: Stellantis (51%), Zhejiang Leapmotor Technology Co. (49%)

Local importer: Stellantis via Leapmotor International

First appeared in Australia: 2024

Aussie sales ranking: 54th

Current model lineup: C10 midsize plug-in / electric SUV, B10 small electric SUV

Lowest starting price in Australia: $43,888 before on-road costs (C10 PHEV ‘Style’ midsize SUV)

Most popular model in Australia: C10

Leapmotor’s Australian division is uniquely composed of several local members of industry, including former Ford Falcon product planner Andy Hoang, who now heads the local arm.

Majority owned by Stellantis (the automotive giant which also owns Peugeot, Jeep, Alfa Romeo and more), Leapmotor also gains access to an expansive Oz dealer network.

Leapmotor currently offers two vehicles: A Tesla Model Y and BYD Sealion 7 rivalling electric midsize SUV known as the C10, and a BYD Atto 3 small electric SUV rival known as the B10. The C10 is also offered with a PHEV drivetrain, chiefly rivalling the BYD Sealion 6.

Read more: Leapmotor C10 Design 2025 review

Founded: 2025

Parent company: Chery Holding Group Co

Local importer: Chery Australia

First appeared in Australia: 2025

Aussie sales ranking: NA

Current model lineup: L8 large SUV, L6 medium/small SUV and L4 small/compact SUV expected

Lowest starting price in Australia: N/A

Most popular model in Australia: N/A

A portmanteau of the words ‘leap’ and ‘passion’, Lepas (presumably pronounced “Leap-pass”) will become Chery’s fourth sub-brand actively trading in Australia, following behind Chery, Omoda, and Jaecoo.

While Chery touts absolute value, and Omoda-Jaecoo promises cut-price luxury, Lepas claims it will focus on sporty, fun cars aimed at style-conscious young buyers.

Lepas has so far confirmed just one flagship model for its local debut, known as the Lepas L8. It presents as a slightly larger than midsize but still five-seater SUV. We expect Lepas to soon bolster its range with its L6 small SUV and L4 compact SUV. More details for those should soon come to light for global markets.

Founded: 2016

Parent company: Zhejiang Geely Holding Group Co.

Local importer: NA, expected to be branded under Geely upon launch

First appeared in Australia: NA, launch planned for 2028

Aussie sales ranking: N/A

Current model lineup: N/A

Lowest starting price in Australia: N/A

Most popular model in Australia: N/A

Lynk & Co was long rumoured to be breaking into the Australian market in 2026, but has since confirmed it will debut in 2028 or later.

Owned by Geely, Lynk and Co’s local sales strategy appears to be as a sports luxury brand, offered as a Geely in-house alternative to sister brand Zeekr.

It is not yet confirmed how Geely, Lynk & Co and Zeekr will co-exist in an extremely crowded Australian market, nor is it confirmed which products the brand intends to sell locally.

Read more: Lynk & Co Australian launch delayed until at least 2028

Founded: 1924 (British ownership), 2006 (Chinese ownership)

Parent company: Shanghai Automotive Industry Corporation (SAIC) Motor Co.

Local importer: SAIC Motor Australia

First appeared in Australia: 1957 (beginning of UK-owned local manufacturing)

Aussie sales ranking: 10th

Current model lineup: Cyberster electric sportscar, HS midsize SUV, MG3 small hatch, MG4 small electric hatch, MG5 medium sedan, QS large SUV, S5 small electric SUV, ZS small SUV, U9 dual-cab ute

Lowest starting price in Australia: $21,990 drive-away (MG3 ‘Vibe’ small hatchback)

Most popular model in Australia: MG ZS

For some, the name MG still invokes memories of British-built MG-B or Midget two-door sports coupes, but for many, that philosophy lives long in the past, with the brand now representing a myriad of cheap, Chinese assembled family cars offering bang-for-buck.

MG, a subsidiary of BMC, then British Leyland, then Rover, has been owned by China’s SAIC Motors since 2007. The brand made a triumphant return to Australia in 2016, and has seen continued success since. As of H2 2024, MG is the 10th most popular car brand in Oz.

Read more: MG U9 2026 Review: Pre-Production Test

Founded: 2014

Parent company: Publicly owned company on the New York Stock Exchange

Key shareholders:

Local importer: Not confirmed, Ateco likely to be selected

First appeared in Australia: N/A

Aussie sales ranking: N/A

Current model lineup: N/A, expect Firefly compact electric SUV to headline brand launch

Lowest starting price in Australia: N/A

Most popular model in Australia: N/A

Nio is a publicly listed Chinese car company which focuses on premium electric vehicles. It is expected to soon enter the Australian market with its Firefly compact electric city car, which would sit a peg above BYD’s Dolphin.

Read more: Nio ET5: 1000km range for Chinese electric sedan

Founded: 2000 Nanjing Golden Dragon Bus (now known as Skywell), 1988 (Skyworth)

Parent company: Skyworth Group Co.

Local importer: EV Automotive

First appeared in Australia: 2021

Aussie sales ranking: N/A

Current model lineup: Skywell EC11 large electric cargo van, EC1 large electric crew cab, EC2 medium electric cargo van, Skyworth BE11 midsize electric SUV

Lowest starting price in Australia: $48,990 (Skyworth BE11 ‘Comfort’ midsize SUV)

Most popular model in Australia: N/A

Skyworth originally began as an affordable electronics company, most known for its production of smart TVs. In 2017, Skyworth partnered with commercial bus manufacturer Nanjing Golden Dragon Bus (known as Skywell in O/S markets) to create Skyworth Auto.

Skyworth Auto is a fresh and relatively unknown face in the Australian market. It currently imports just one passenger vehicle, the BE11 electric midsize SUV, while sister commercial brand Skywell imports full electric models EC11 large commercial van, EC2 medium commercial van, and EC1 large crew cab / light truck, built on a van platform.

Read more: Skyworth BE11 confirmed – with three other vehicles also on the way

Founded: 1994 (Initial concept) 1997 (brand officially launched as ‘Smart’)

Parent companies: Mercedes-Benz AG (50%), Zhejiang Geely Holding Group (50%)

Local importer: LSH Auto Australia

First appeared in Australia: 2003

Aussie sales ranking: Information not available

Current model lineup: #1 compact electric SUV, #3 small electric SUV

Lowest starting price in Australia: $54,900 before on-road costs (#1 Pro+)

Most popular model in Australia: Information not available

Eyebrows may be raised at the mention of Smart when discussing Chinese car brands. The brand is most commonly associated with its once sole owner Mercedes-Benz, who established Smart Car to sell a variety of compact city and micro cars in the early 2000s.

But in 2019, Mercedes sold 50-percent of its Smart stake to Geely Holding Group – a Chinese automotive manufacturing giant which also owns Zeekr, Lotus, Volvo and others. Since then, the brand has seen colossal reform, now headquartered in Ningbo, China.

Gone are the days of the soulful, plucky and downright weird Smart cars. The company has pivoted towards risk-free, mainstream, and conventional sized electric SUV products — all of which are built in China — in an effort to snag a greater market share globally.

Read more: Smart #1 and Smart #3 2024 review

Founded: 2016

Parent company: Baoding Great Wall Holdings Company

Local importer: GWM Australia

First appeared in Australia: 2025

Aussie sales ranking: N/A

Current model lineup: Blue Mountain large plug-in hybrid SUV, G9 plug-in hybrid large people-mover

Lowest starting price in Australia: N/A

Most popular model in Australia: N/A, Blue Mountain expected to outsell G9

GWM has followed in the footsteps of BYD / Denza and MG Motors / IM Motors with the debut of its luxury sub-division Wey. Launching in Australia with two large, powerful plug-in hybrids, Wey takes on Denza, IM Motors, Zeekr, and to a lesser extent, Omoda Jaecoo, as a high value luxury sub-brand which undercuts more established, conventional luxury brands like Lexus, Mercedes-Benz, Audi and more.

Read more: GWM’s Wey luxury brand set for Australia to fight Zeekr, Denza, IM Motors

Founded: 2014

Parent company: Public company traded on the New York Stock Exchange and the Hong Kong Stock Exchange.

Key shareholders:

Local importer: TrueEV

First appeared in Australia: 2024

Aussie sales ranking: Information not available

Current model lineup: G6 midsize electric SUV, G9 large electric SUV, X9 electric MPV

Lowest starting price in Australia: $54,800 before on-road costs (G6 Standard Range)

Most popular model in Australia: G6

Xpeng might appear to be just another Chinese car company, but it lays claim to colossal-name financial backers behind the scenes, including mobile phone manufacturer Xiaomi, Volkswagen Group, Alibaba, Foxconn and more.

Currently, Xpeng offers just one car in Australia – the Tesla Model Y-rivalling G6, but intends to expand its all electric model range in coming years to include its G9 large SUV and X9 people mover – a body style extremely popular in China, yet largely overlooked in Oz.

Read more: XPeng G6 Long Range 2025 review

Founded: 2021

Parent company: Zhejiang Geely Holding Group

Local importer: Zeekr Australia

First appeared in Australia: 2024

Aussie sales ranking: 43rd

Current model lineup: X small electric SUV, 7X medium electric SUV, 009 electric MPV

Lowest starting price in Australia: $49,900 before on-road costs (Zeekr X RWD)

Most popular model in Australia: Zeekr X

Zeekr entered the Australian market in 2024 as a luxury arm to Geely. Much like other Chinese-owned luxury offshoot brands operating in Australia, including Omoda-Jaecoo, Denza, and IM Motors, Zeekr offers a high value proposition at a premium yet competitive price.

The brand is quick to lean on its Swedish ties, with Zeekr’s global design centre located in Gothenburg. Note that parent company Geely also owns Volvo Cars, another Swedish-based brand which has outsourced nearly all vehicle assembly to China.

Read more: Zeekr confirms Super Hybrid PHEV coming to Australia in 2026, 8X most likely candidate

Latest guides

About Chasing cars

Chasing Cars reviews are 100% independent.

Because we are powered by Budget Direct Insurance, we don’t receive advertising or sales revenue from car manufacturers.

We’re truly independent – giving you Australia’s best car reviews.