-

Car Reviews

- All reviews

- Midsize SUVs

- Small cars

- Utes

- Small SUVs

- Large SUVs

- Large cars

- Sports SUVs

- Sports cars

- Vans

Latest reviews

- Car News

-

Car Comparisons

Latest comparisons

- Chasing Deals

New brand aims to replicate strong JD Power quality survey results from China while growing model and dealer count rapidly over 24 months

Incoming Chinese manufacturer GAC — short for Guangzhou Automotive Group — has told Chasing Cars that it will not engage in price wars with rivals, and that as a consequence, it will not be the cheapest ‘new brand’ in the market.

Speaking with Chasing Cars, GAC Australia deputy general manager Cheney Liang said that the firm intends to replicate the manufacturer’s reputation for high quality in the Chinese market.

“These vehicles are supported by world-class quality and have been hand-picked to suit the needs of Australia. They have been the subject of intense R&D and will be supported by service and warranty care that suit the expectations of this market,” said Liang.

“We are exceptionally confident in our ability to deliver a top-level customer experience and GAC has continually been the number one in China’s JD Power survey for customer satisfaction,” Liang said.

In 2025, GAC Honda — one of the Guangzhou firm’s key joint ventures — rated highest for intial quality among “mass market” brands in the Chinese JD Power survey.

GAC will likely pair its offshore reputation for quality with long warranty periods when it arrives in Australia next year. Competitors Chery, BYD and MG all offer a warranty period of six years or more.

While pricing on GAC’s first three models for Australia to be announced in mid-November, Chasing Cars understands that the Aion V electric midsize SUV will not undercut smaller rivals like the Leapmotor B10 ($39,000 driveaway) or MGS5 EV (from $40,990 driveaway).

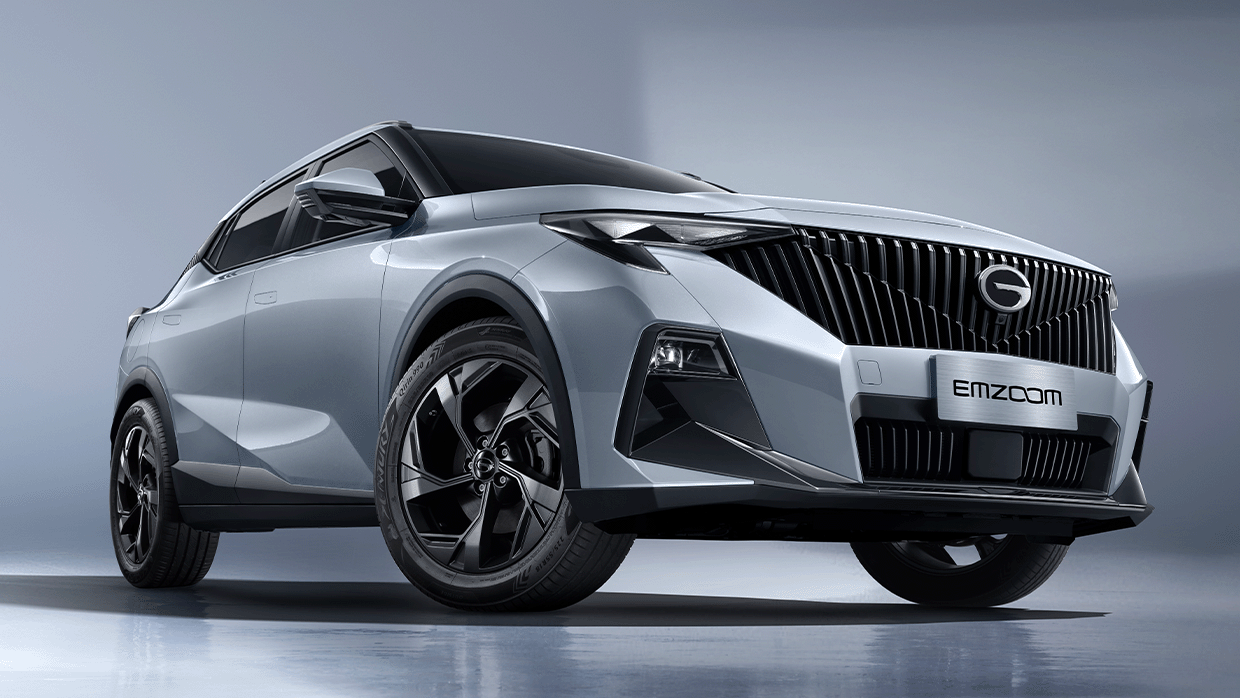

That said, GAC will have a price-leading model in its petrol-only Emzoom small SUV, while the the firm’s third launch model — the M8 plug-in hybrid (PHEV) people mover —is expected to have semi-premium positioning.

In Australia, the GAC lineup will consist of models from three sub-brands: GAC itself, for petrol and hybrid products, Aion for pure electric models, and in future, Hyptec, for premium fully electric vehicles.

Hyptec will join the Australian lineup in the future with a higher-performance offering, while a ute model and a large SUV are also high on GAC Australia’s priority list.

By the end of 2027 the GAC range in Australia will swell from the initial three models to eight, with two launches planned for 2026 and three planned for 2027. Dealer count is expected to move from 12 to 20 in that time.

Globally, GAC’s portfolio consists of models with petrol, hybrid, PHEV and range-extender PHEV, and fully electric powertrains and all are on the table for Australia depending on customer demand.

Liang said that while GAC was keenly aware of the need to get customers into one of the company’s initial 12 dealerships, it intended to do so by demonstrating value for money rather than outright bargain pricing.

“We are not chasing the [lowest] price,” Liang said.

“I believe for consumers, they have [both] price and value on their mind. What is most suitable is that the price matches the value, so we will bring value to the customer, even if that is not at the lowest price.”

To that end, Liang revealed that GAC will embark on a significant, targeted social media campaign with each of the firm’s three distinct models directed at different audiences.

GAC also plans to attack what is perceived as a significant weakness of new brands in Australia by establishing an extensive parts and logistics network from the get-go.

The firm has set up seven major parts warehouses globally — and number seven is in Melbourne, Victoria.

“We have already signed a contract with an Australian [logistics] company, and we will do the logistics from door-to door,” said Liang.

“As soon as we have the dealer [parts] order, the same day they will send out the parts.”

Some rival brands have suffered from poor parts supply in Australia in recent years, leading to longer vehicle off-road statistics for some models and, in some cases, associated higher insurance premiums due to parts difficulties.

Latest news

About Chasing cars

Chasing Cars reviews are 100% independent.

Because we are powered by Budget Direct Insurance, we don’t receive advertising or sales revenue from car manufacturers.

We’re truly independent – giving you Australia’s best car reviews.