-

Car Reviews

- All reviews

- Midsize SUVs

- Small cars

- Utes

- Small SUVs

- Large SUVs

- Large cars

- Sports SUVs

- Sports cars

- Vans

Latest reviews

- Car News

-

Car Comparisons

Latest comparisons

- Chasing Deals

Solid numbers in the new car markets with January numbers up marginally over this time last year despite a drop in ICE sales

Australia’s 2026 new-vehicles sales race is off to a solid start, with 87,753 sales recorded for the month of January, a respectable increase of 949 vehicles over January 2025.

This could be a very early indicator that the Aussie market will again reach new heights in 2026, following 2025’s all-time sales record.

The biggest-selling model in January was Ford Ranger (3403 units), with a dominant win over arch rival Toyota HiLux (2800) as the latter transitions its new generation into showrooms.

A Toyota Australia spokesperson told Chasing Cars that the relatively soft HiLux result owes much to a ramp-up of stock of the new-generation model, launched in December, and the timing of stock into showrooms reflects the drop in vehicle registrations.

The evergreen Mazda CX-5 (2289) was the most popular passenger car in the first month of the year, followed by Chery Tiggo 4 Pro (2234) and Mitsubishi Outlander (1975).

A habitual sales winner, the Toyota RAV4 (1757), just scraped into the Top 10, the model in the current generation’s twilight with its replacement soon for local launch. Ford Everest (1913), Hyundai Kona (1839), Isuzu D-Max (1798) and Haval Jolion (1789) complete the 10 best-seller slots for January.

According to Toyota Australia, the unusually low RAV4 result is a direct result of a building order bank for the new-gen model, due in showrooms late March. The local arm also said it has not offered run-out deals on outgoing-gen RAV4 and HiLux models, which also impacts January figures for both models.

Toyota’s dominance waned slightly (16.3 percent market share) over the circa 20-percent market share enjoyed in recent sales months. But while its 14,310 sales pale in comparison to the circa-18K sales recorded in January 2025, the Big T still outsold its nearest rival Mazda (7692 units) by almost two to one.

Kia had a notably strong January, coming in third (6600) above Ford (6116), with Hyundai (5856) rounding out the Top Five.

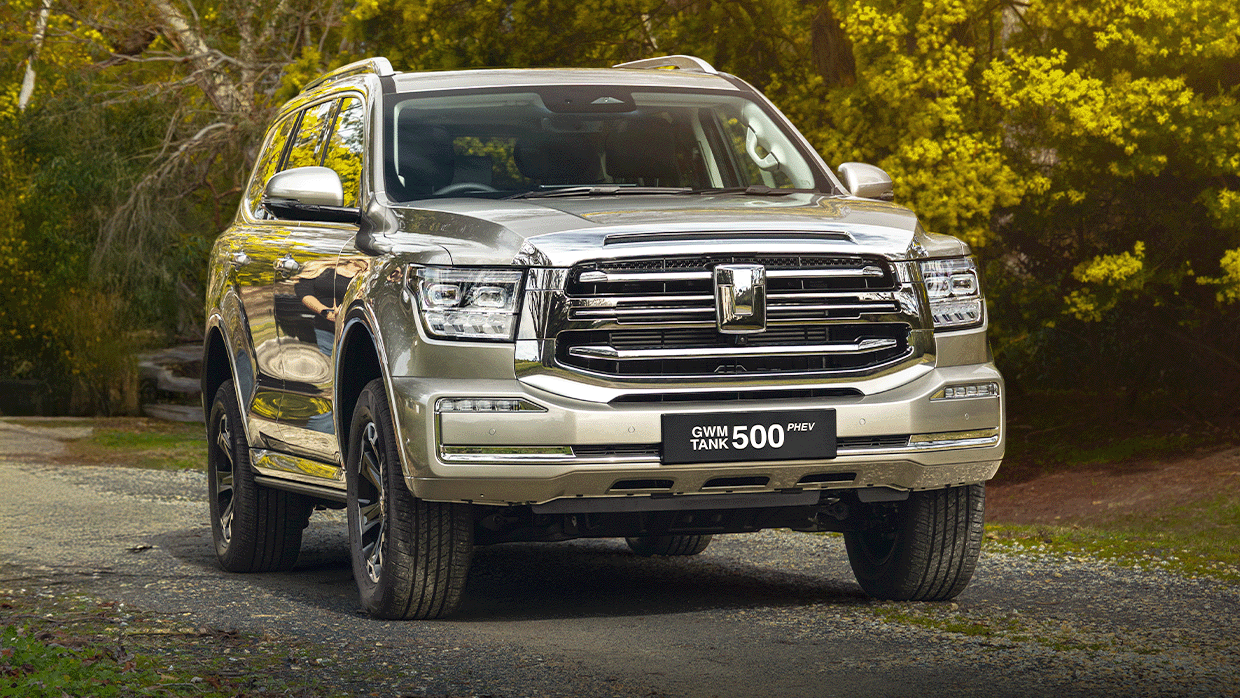

Chinese brands continue to penetrate the sharp end of the sales market, with BYD (5001), GWM (4509), Chery (3780) and MG (3123) all scoring Top 10 standings, with Japan’s Mitsubishi holding out eighth place (4347).

Further, China proved to comfortably sit as the second-largest source of new vehicles with Aussie buyers behind Japan, with vehicles sold from China having grown by 68.6 percent over the past year.

SUVs remain the most popular vehicle type in Australia through January, with 53,666 sales compared with light commercials (17,995) and other (non-SUV) passenger cars (13,623). Both passenger cars (4.6 percent) and SUVs (1.0 percent) were up versus figures from January 2025, while light commercials were down slightly (-2.5 percent).

Further broken down, medium SUVs (21,785) proved most popular with Aussie buyers, followed by small SUVs (15,067), 4×4 Pick-Ups/Cab Chassis (13,650) and large SUVs (11,412) with a far gap to the fifth most popular segment, small passenger cars (5946).

In terms of powertrain type, PHEVs (5161) continue to enjoy a constant surge in popularity, with a whopping 170.5 percent rise over January 2025, albeit with a much smaller market share (5.9 percent) than regular (self-charging) hybrids (15,131 and 17.4 percent). BEVs (7409) accounted for 8.4 percent.

Petrol (33,144) managed to outsell hybrid (15,131) two to one, but the most popular power choice in Australia was down a significant 14 percent over January 2025 numbers. Diesel proved the second-most popular powertrain of choice, with 24,439 new oilers registered in January 2026.

Latest news

About Chasing cars

Chasing Cars reviews are 100% independent.

Because we are powered by Budget Direct Insurance, we don’t receive advertising or sales revenue from car manufacturers.

We’re truly independent – giving you Australia’s best car reviews.