-

Car Reviews

- All reviews

- Midsize SUVs

- Small cars

- Utes

- Small SUVs

- Large SUVs

- Large cars

- Sports SUVs

- Sports cars

- Vans

Latest reviews

- Car News

-

Car Comparisons

Latest comparisons

- Chasing Deals

Guangzhou Auto Group will be the latest Chinese car maker to have a crack down under with an all too familiar lineup set to arrive by end of 2026

GAC, not to be confused with JAC, is firming for an Australian launch as it establishes a baseline dealer network across Australia.

The Chinese State-owned company is anticipated to launch imminently with three vehicles spanning multiple powertrains – although Oz-market specifications of these vehicles are yet to be confirmed.

Spearheading the model range is the GAC AION V, which first appeared locally at the Mobility Live Australia event last year. The AION, short for “AI ON THE ROAD”, is a small electric SUV. It measures 4605mm long,1854mm wide, and 1686mm tall, with a 2775mm wheelbase.

It will primarily contend with the $40,990 driveaway MG S5 and $39,990 (before on-roads) BYD Atto 3, and will need to cost around $40,000 if it is to be a real market contender.

Key details surrounding the AION V’s powertrain are not confirmed. However, battery sizes range globally from 62 kWh, 75.3 kWh or 90 kWh.

Maximum power output from the AION’s single front-mounted electric motor is quoted between 100kW and 165kW.

GAC’s second introductory model remains on-trend for predictability – a front-driven dedicated-combustion small SUV known as the Emzoom or GS3. Expect power to come from a 130kW turbocharged four-cylinder engine mated to a seven-speed dual clutch automatic transmission.

It measures 4410mm long, 1850mm wide, and 1600mm tall, with a 2650mm wheelbase – primarily contending with the similar sized MG ZS and Chery Tiggo 4. Expect the Emzoom/GS3 to cost around $25,000 (drive away) if it intends to compete with its cut price rivals.

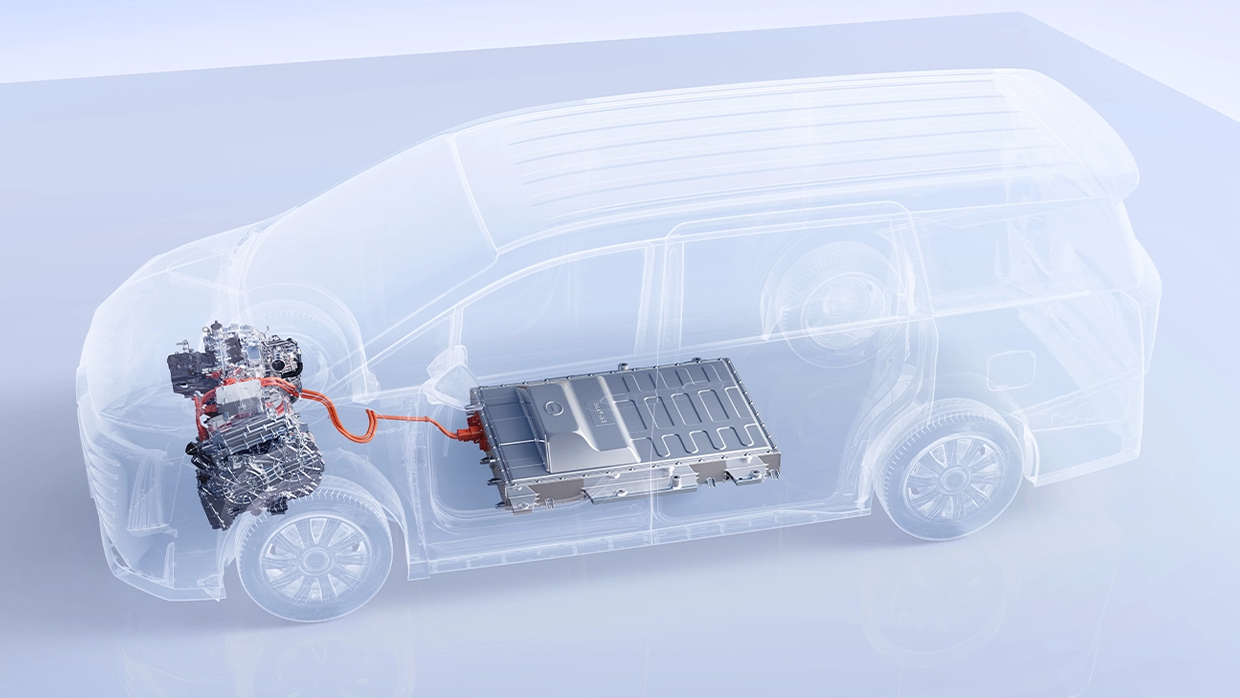

Third off the rank for the Chinese automaker is a left of field choice; a 5193mm long MPV known as the E9, which uniquely features a PHEV powertrain – a first for Oz.

The E9’s front-driven PHEV platform features a two-litre turbocharged petrol engine, two-speed integrated hybrid transmission, and 25.57kWh battery. Combined output for this system is quoted to be an impressive 274kW/630Nm.

In China, the MPV market is thriving, comprising around five percent of the passenger vehicle market in 2024 with 1.088 million sales. In Australia though, the market is lukewarm – and dominated by the Kia Carnival.

Last year, MPV sales comprised just 1.2 percent of the total Australian car market. 74 percent of those sales went to the Kia Carnival. The E9 will need to be priced extremely sharply if it is to contend with the Carnival, which starts at $51,070.

GAC joins an evergrowing list of successful automakers from China looking to secure a footing in Australia, with the company describing Australia as a “lucrative opportunity”.

Other brands in the local market who sharing a similar philosophy include Xpeng, Geely, Zeekr, BYD, Chery, Foton, JAC, LDV, GWM, Deepal, MG, IM Motors, Leapmotor, Jaecoo, Omoda, Skywell, Smart, and more every month it seems.

Latest news

About Chasing cars

Chasing Cars reviews are 100% independent.

Because we are powered by Budget Direct Insurance, we don’t receive advertising or sales revenue from car manufacturers.

We’re truly independent – giving you Australia’s best car reviews.